Exxon Mobil (XOM)

153.44

-1.09 (-0.71%)

NYSE · Last Trade: Feb 12th, 12:02 PM EST

Detailed Quote

| Previous Close | 154.53 |

|---|---|

| Open | 153.89 |

| Bid | 153.44 |

| Ask | 153.47 |

| Day's Range | 152.85 - 155.25 |

| 52 Week Range | 97.80 - 156.93 |

| Volume | 7,516,536 |

| Market Cap | 649.60B |

| PE Ratio (TTM) | 44.09 |

| EPS (TTM) | 3.5 |

| Dividend & Yield | 4.120 (2.69%) |

| 1 Month Average Volume | 21,389,793 |

Chart

About Exxon Mobil (XOM)

Exxon Mobil is a multinational oil and gas corporation engaged in the exploration, production, refining, and distribution of petroleum and petrochemical products. The company operates in various segments, including upstream operations, which involve the extraction of crude oil and natural gas, and downstream operations, which focus on refining and marketing fuels and lubricants. Additionally, Exxon Mobil invests in alternative energy solutions and technologies, contributing to ongoing efforts to address global energy challenges. With a significant presence in multiple countries, the company plays a vital role in supplying energy and products to meet the demands of consumers and industries worldwide. Read More

News & Press Releases

In a move that signals the dawn of a new era for independent energy producers, Devon Energy (NYSE:DVN) and Coterra Energy (NYSE:CTRA) announced a definitive $58 billion merger agreement on February 2, 2026. This all-stock "merger of equals" is designed to create a premier large-cap shale operator, specifically

Via MarketMinute · February 12, 2026

Infosys and ExxonMobil are expanding their collaboration to develop advanced cooling technologies for data centers.

Via Benzinga · February 12, 2026

Chevron is up big in 2026 as part of a rip-roaring rally in energy stocks.

Via The Motley Fool · February 12, 2026

Energy stocks are in the spotlight, and ExxonMobil is best in breed.

Via The Motley Fool · February 11, 2026

January's positive jobs data reduces the likelihood of upcoming Fed rate cuts, while Robinhood falls on revenue miss, today, Feb. 11, 2026.

Via The Motley Fool · February 11, 2026

As we move into the second month of 2026, the financial community has coalesced around a singular, aggressive target for the U.S. stock market: a 15% growth in earnings per share (EPS) for the S&P 500. This benchmark is not merely an optimistic forecast but is increasingly viewed

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy market has become a theater of conflicting forces, leaving investors and analysts grappling with unprecedented volatility. On one side, the U.S. administration’s aggressive "Drill, Baby, Drill" policy has unleashed a torrent of new domestic production, pushing West Texas Intermediate (WTI)

Via MarketMinute · February 11, 2026

As the Trump administration enters its second year, a seismic shift in the American legal and economic landscape is reaching a fever pitch. What began as a series of "Day One" executive orders has evolved into a massive, coordinated legal offensive by U.S. corporations to dismantle the regulatory framework

Via MarketMinute · February 11, 2026

WASHINGTON D.C. — In a sweeping transformation of the federal government not seen in decades, the Office of Budget, Balance, and Bureaucratic Accountability (OBBBA) has initiated a massive "operational efficiency" review, marking the formal beginning of what Wall Street is calling the "Great Regulatory Purge." This aggressive restructuring, authorized under

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy landscape finds itself trapped in a high-stakes waiting game. Despite a cooling U.S. labor market and "weaker than expected" retail sales, oil prices remain stubbornly resilient, underpinned by a thick layer of geopolitical anxiety. The primary driver is the ongoing diplomatic

Via MarketMinute · February 11, 2026

In a move that signals the next massive wave of consolidation in the American energy sector, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) have announced a definitive agreement to combine in an all-stock "merger of equals" valued at approximately $58 billion. Announced on February 2, 2026, the transaction

Via MarketMinute · February 11, 2026

Explore how these two dividend ETFs differ in cost, sector focus, and risk to help refine your income investing strategy.

Via The Motley Fool · February 11, 2026

In a move that signals the most significant realignment of Western energy interests in South America in decades, the U.S. Department of the Treasury has issued General License 48 (GL 48). This landmark policy shift authorizes U.S. companies to resume the delivery of critical oil production equipment, technology,

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy landscape is teetering on the edge of a significant supply disruption following a series of aggressive maritime interdictions by the United States. On February 9, US naval forces successfully boarded and seized the Aquila II, a crude oil tanker allegedly part of

Via MarketMinute · February 11, 2026

As delegates and energy titans gather in London for the 2026 International Energy Week (IE Week), the mood has shifted from the supply-security anxieties of years past to a starker, more bearish reality. A new consensus has emerged among top analysts and institutional forecasters, placing the outlook for Brent Crude

Via MarketMinute · February 11, 2026

The move allows traders to own a stake in mega-cap firms like Nvidia, Tesla, Meta and Alphabet, without owning the underlying shares.

Via Stocktwits · February 11, 2026

The Vanguard High Dividend Yield ETF and the Schwab U.S. Dividend Equity ETF both aim to deliver reliable income, but they go about it in very different ways. This comparison explains which approach is better suited for investors who depend on their dividends to hold steady through changing markets.

Via The Motley Fool · February 10, 2026

The iShares Core High Dividend ETF is up 12% this year.

Via The Motley Fool · February 10, 2026

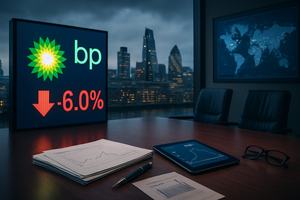

In a move that sent ripples through the global energy sector, BP (NYSE: BP) announced on February 10, 2026, that it would immediately suspend its $750 million quarterly share buyback program. The decision marks a dramatic departure from the company’s recent strategy of aggressive shareholder returns, signaling a pivot

Via MarketMinute · February 10, 2026

As of February 10, 2026, the global energy landscape finds itself at a crossroads between the urgent demands of decarbonization and the immediate realities of energy security. At the heart of this tension stands BP p.l.c. (NYSE: BP, LSE: BP), a company that has spent the last five years attempting one of the most ambitious [...]

Via Finterra · February 10, 2026

If you're searching for dividend stocks in the energy sector, these two stocks are solid choices.

Via The Motley Fool · February 10, 2026

— Advancing High-Quality Exploration and Development Through Cutting-Edge Technologies

Via Press Release Distribution Service · February 10, 2026

These two Vanguard ETFs are popular among investors for dividend income. But one looks a bit better.

Via The Motley Fool · February 9, 2026

Via Benzinga · February 9, 2026

In a move that signals the dawn of a new era for independent energy producers, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) announced a definitive $21.4 billion all-stock merger on February 2, 2026. This transformative deal creates a "mega-independent" with a combined enterprise value of approximately $58

Via MarketMinute · February 9, 2026