Latest News

As of February 9, 2026, the global mining landscape has been fundamentally reshaped by a historic bull run in precious metals. At the center of this transformation is Barrick Gold (NYSE: GOLD), a company that has translated record-high gold prices into a financial masterclass. With realized gold prices averaging over $3,501 per ounce in the [...]

Via Finterra · February 9, 2026

Today, February 9, 2026, marks a watershed moment for Becton, Dickinson and Company (NYSE: BDX). The medical technology giant, commonly known as BD, has officially closed its transformative $17.5 billion combination with Waters Corporation (NYSE: WAT), effectively spinning off its Biosciences and Diagnostic Solutions units to create a more streamlined "New BD." Simultaneously, the company [...]

Via Finterra · February 9, 2026

For fiscal year 2026, the company projects total revenue of $1.452 billion to $1.462 billion, representing 18% to 19% Year-over-Year growth.

Via Stocktwits · February 9, 2026

Via Benzinga · February 9, 2026

Jerash Holdings (NASDAQ:JRSH) Soars on Strong Q3 Earnings Beat and Margin Expansionchartmill.com

Via Chartmill · February 9, 2026

As of February 9, 2026, the American steel industry finds itself at a crossroads of industrial reshoring and fiscal recalibration. At the center of this narrative is Cleveland-Cliffs (NYSE: CLF), North America’s largest flat-rolled steel producer and a cornerstone of the automotive supply chain. The company’s latest earnings report, released today, has sent ripples through [...]

Via Finterra · February 9, 2026

Hain Celestial (HAIN) Q2 2026 Earnings Transcript

Via The Motley Fool · February 9, 2026

On February 9, 2026, the telehealth landscape faces a reckoning. Hims & Hers Health (NYSE: HIMS), a company that once seemed invincible during the weight-loss drug gold rush of 2025, is currently grappling with a sharp 20% decline in its stock price over the past week. The catalyst for this sudden valuation haircut is a [...]

Via Finterra · February 9, 2026

Motorcar Parts of America (NASDAQ:MPAA) Shares Plunge on Earnings Miss and Lowered Guidancechartmill.com

Via Chartmill · February 9, 2026

Via Benzinga · February 9, 2026

Today, February 9, 2026, marks a pivotal moment for Monday.com (NASDAQ: MNDY) as the company released its fiscal 2026 revenue guidance. Once the darling of the "Work OS" and software-as-a-service (SaaS) sector, the company is navigating a complex transition from high-velocity growth to mature, multi-product enterprise scaling. While Monday.com remains a powerhouse in organizational efficiency, [...]

Via Finterra · February 9, 2026

As of February 9, 2026, Apollo Global Management (NYSE: APO) has firmly established itself not just as an alternative asset manager, but as a central pillar of the global financial architecture. Once known primarily for its aggressive private equity buyouts, the firm has undergone a seismic transformation into a "private credit powerhouse" and a leader [...]

Via Finterra · February 9, 2026

Palantir Technologies Inc. (PLTR) stock surged premarket on Monday, continuing Friday's gains amid volatile software sector.

Via Benzinga · February 9, 2026

Via Benzinga · February 9, 2026

Dynatrace (DT) Q3 2026 Earnings Call Transcript

Via The Motley Fool · February 9, 2026

Plug Power has a plan to start turning a profit.

Via The Motley Fool · February 9, 2026

Edgewell (EPC) Q1 2026 Earnings Call Transcript

Via The Motley Fool · February 9, 2026

Via Benzinga · February 9, 2026

Strategy (NASDAQ:MSTR) on Monday announced it had bought 1,142 Bitcoin

Via Benzinga · February 9, 2026

3 investments all linked to one another. BTC, COIN & MSTR.

Via Talk Markets · February 9, 2026

Via Benzinga · February 9, 2026

Via MarketBeat · February 9, 2026

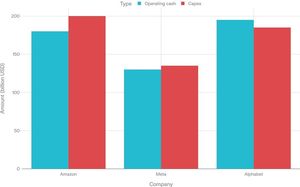

These tech stocks can deliver big gains -- and modest distributions.

Via The Motley Fool · February 9, 2026

BDX Q1 2026 adjusted earnings of $2.91/share beats consensus of $2.81. Sales of $5.25B slightly above consensus of $5.15B.

Via Benzinga · February 9, 2026

Via Benzinga · February 9, 2026

Last year, the dollar posted its worst annual performance in 8 years, driven primarily by geopolitical concerns.

Via Talk Markets · February 9, 2026

ON is in the spotlight Monday ahead of the company's fourth-quarter earnings report today after the market closes.

Via Benzinga · February 9, 2026

These ETFs still look like great opportunities to buy into a major trend.

Via The Motley Fool · February 9, 2026

STMicroelectronics sits at the center of Musk's Moon push and Bezos' AI race after a 10-year SpaceX tie-up and a multibillion AWS deal.

Via Benzinga · February 9, 2026

Pulse Biosciences stock rises after new study data showed strong early results for its heart treatment device, helping shares outperform a weak broader market.

Via Benzinga · February 9, 2026

Via Benzinga · February 9, 2026

Kroger stock advanced on Monday after announcing its new CEO is former Walmart executive Greg Foran.

Via Investor's Business Daily · February 9, 2026

Via Benzinga · February 9, 2026

Oracle stock was upgraded to a buy rating from analysts at DA Davidson on Monday, who are more positive on a "revamped" OpenAI.

Via Investor's Business Daily · February 9, 2026

Eli Lilly shares rise after announcing a $2.4 billion deal to buy Orna Therapeutics, strengthening its push into genetic medicine despite mixed markets.

Via Benzinga · February 9, 2026

Ouster is trending Monday after gaining momentum Friday. The company announced today it acquired StereoLabs.

Via Benzinga · February 9, 2026

Gold reclaims the $5,000 level as a weaker US Dollar and a supportive macro backdrop help stabilise prices.

Via Talk Markets · February 9, 2026

Coca-Cola (KO) to release Q4 earnings on Feb. 10, analysts expect 56 cents/share. Its annual dividend yield is 2.58%, with potential gains for investors.

Via Benzinga · February 9, 2026

Elon Musk's faster moon timeline is really a chip story — and Nvidia, Broadcom, and STM could see real demand from SpaceX's buildout.

Via Benzinga · February 9, 2026

Curbline (CURB) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 9, 2026

Rivian stock is back on sale.

Via The Motley Fool · February 9, 2026

Can Infleqtion turn $29M in revenue into a $300M business? Its IPO bets on a 10x jump powered by quantum sensing and defense demand.

Via Benzinga · February 9, 2026

Software stocks just suffered their worst-ever drop versus the S&P 500, but Goldman Sachs sees AI fears as overblown and highlights four top buy opportunities.

Via Benzinga · February 9, 2026