General Motors (GM)

79.93

+0.00 (0.00%)

NYSE · Last Trade: Feb 13th, 6:54 AM EST

Detailed Quote

| Previous Close | 79.93 |

|---|---|

| Open | - |

| Bid | 79.30 |

| Ask | 82.05 |

| Day's Range | N/A - N/A |

| 52 Week Range | 41.60 - 87.62 |

| Volume | 800 |

| Market Cap | 72.26B |

| PE Ratio (TTM) | 24.67 |

| EPS (TTM) | 3.2 |

| Dividend & Yield | 0.6000 (0.75%) |

| 1 Month Average Volume | 9,080,132 |

Chart

About General Motors (GM)

General Motors is a leading global automotive company that designs, manufactures, and sells a diverse range of vehicles, including cars, trucks, and SUVs under various brand names. The company is committed to innovation in transportation, focusing on the development of electric and autonomous vehicles to meet the evolving needs of consumers and address environmental challenges. With a rich history in the automotive industry, General Motors also emphasizes safety, performance, and technology integration in its products while working toward sustainability initiatives and expanding its presence in the global market. Read More

News & Press Releases

Trump ends EV era with EPA rollback. Ford, GM, and truckers gain as emission costs vanish and the "endangerment finding" is repealed.

Via Benzinga · February 13, 2026

The finding by the Obama administration forms the basis for U.S. actions to reduce greenhouse emissions and fight climate change, including the laws on vehicle tailpipe emissions which have aided the transition to electric vehicles.

Via Stocktwits · February 12, 2026

Salesforce signed a deal to acquire Cimulate, an AI-powered product discovery startup. The acquisition strengthens Agentforce Commerce with better search and personalized shopping.

Via Barchart.com · February 12, 2026

It's hugely important for investors to stay aware of which automakers' products are well received.

Via The Motley Fool · February 12, 2026

GM increased its 2026 dividend by 20%, and while its dividend yield is below Ford's, it looks like a better buy compared to the Blue Oval.

Via Barchart.com · February 11, 2026

In a dramatic shift that has caught many Wall Street analysts off guard, the first two weeks of February 2026 have witnessed a historic "Great Rotation" within the equity markets. The Russell 2000 Index (IWM), which tracks domestic small-cap companies, has staged its most aggressive rally in decades, significantly outperforming

Via MarketMinute · February 11, 2026

The S&P 500 Index retreated further from its historic peaks on Wednesday, closing at 6,914.75, a decline of 0.39% for the session. This pullback marks a significant cooling period for a market that only weeks ago, on January 28, 2026, celebrated a record-shattering high of 7,

Via MarketMinute · February 11, 2026

Record revenue, deep EV losses, and a sharp pivot toward hybrids are reshaping this automaker's profit story, today, Feb. 11, 2026.

Via The Motley Fool · February 11, 2026

Today, February 11, 2026, GlobalFoundries (NASDAQ: GFS) finds itself at the center of the semiconductor narrative following a high-stakes Q4 2025 earnings release that has sent ripples through the industry. Despite a broader climate of cautious tech spending, the Malta, New York-based foundry delivered a significant "beat and raise" on profitability, underscored by a fresh [...]

Via Finterra · February 11, 2026

Date: February 11, 2026 Introduction Ford Motor Company (NYSE: F) finds itself at a critical crossroads today, following the release of its full-year 2025 earnings report. In a year defined by extreme volatility—ranging from massive supply chain disruptions to a fundamental pivot in its electric vehicle (EV) strategy—the Detroit giant has emerged with a narrative [...]

Via Finterra · February 11, 2026

Ford held steady as investors looked past day-to-day price moves and toward whether earnings can support a clearer path to improved profitability.

Via The Motley Fool · February 10, 2026

BYD is suing the Trump administration over a 100% EV tariff — and the outcome could reshape the U.S. market for Tesla, Ford, and GM.

Via Benzinga · February 10, 2026

As the closing bell approaches on February 10, 2026, Wall Street is bracing for a dual-threat earnings afternoon that promises to serve as a litmus test for two of the market's most watched sectors: the automotive transition and the retail finance revolution. Ford Motor Company (NYSE:F) and Robinhood Markets

Via MarketMinute · February 10, 2026

As of February 10, 2026, Ford Motor Company (NYSE: F) stands at a defining crossroads in its 123-year history. After a turbulent 2025 that saw the company navigate significant supply chain disruptions and a massive restructuring of its electric vehicle (EV) ambitions, Ford is currently the primary case study for "legacy" transition in the automotive [...]

Via Finterra · February 10, 2026

In a dramatic reversal of fortune for the beleaguered electric vehicle sector, Polestar Automotive Holding UK PLC (NASDAQ: PSNY) saw its shares skyrocket by nearly 32% on Friday, February 6, 2026. The surge, which propelled the stock to a closing price of $19.42, marks the company’s most significant

Via MarketMinute · February 9, 2026

Tesla, Inc. (NASDAQ: TSLA) finds itself at a defining moment in its corporate history following the release of its Q4 2025 earnings report. As of February 9, 2026, the market is grappling with a paradox: Tesla’s core automotive deliveries fell by roughly 9% in 2025, yet its stock price

Via MarketMinute · February 9, 2026

These S&P500 stocks are gapping in today's sessionchartmill.com

Via Chartmill · February 9, 2026

Unhealthy automakers have a date with a nightmare scenario if Chinese EVs sell in the U.S. anytime soon. It's also a massive opportunity -- here's how.

Via The Motley Fool · February 9, 2026

While tariff complications and EV profitability will continue to weigh on bottom lines, this automaker is still driving strong results.

Via The Motley Fool · February 8, 2026

Volkswagen has potentially found a way to roll out EVs while mitigating their short-term problems.

Via The Motley Fool · February 7, 2026

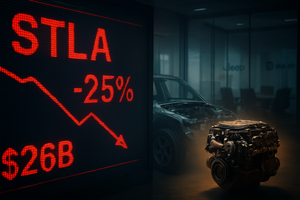

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

BYD is the top dog in the Chinese auto market, but the world's largest EV market is set for a shock in 2026. Can BYD survive and thrive without help from Beijing?

Via The Motley Fool · February 6, 2026

In a staggering reversal that has stunned global commodity markets, gold prices have retreated sharply from their historic record highs, recording a massive 11% correction over the past week. The sell-off, which culminated in a violent "flash crash" on January 30, 2026, saw spot gold tumble from a peak of

Via MarketMinute · February 6, 2026