Household products company WD-40 (NASDAQ:WDFC) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.8% year on year to $163.5 million. On the other hand, the company’s full-year revenue guidance of $642.5 million at the midpoint came in 1.1% below analysts’ estimates. Its GAAP profit of $1.56 per share was 24.3% above analysts’ consensus estimates.

Is now the time to buy WD-40? Find out by accessing our full research report, it’s free for active Edge members.

WD-40 (WDFC) Q3 CY2025 Highlights:

- Revenue: $163.5 million vs analyst estimates of $153.9 million (4.8% year-on-year growth, 6.2% beat)

- EPS (GAAP): $1.56 vs analyst estimates of $1.26 (24.3% beat)

- Adjusted EBITDA: $28.07 million vs analyst estimates of $26.4 million (17.2% margin, 6.3% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $5.95 at the midpoint, in line with analyst estimates

- Operating Margin: 17.1%, up from 15.4% in the same quarter last year

- Free Cash Flow Margin: 17.5%, similar to the same quarter last year

- Market Capitalization: $2.69 billion

“We delivered solid results in fiscal 2025, with currency adjusted pro forma net sales of $603 million—an increase of 6 percent over last year and in line with our expectations,” said Steve Brass, president and chief executive officer of WD-40 Company.

Company Overview

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $620 million in revenue over the past 12 months, WD-40 is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

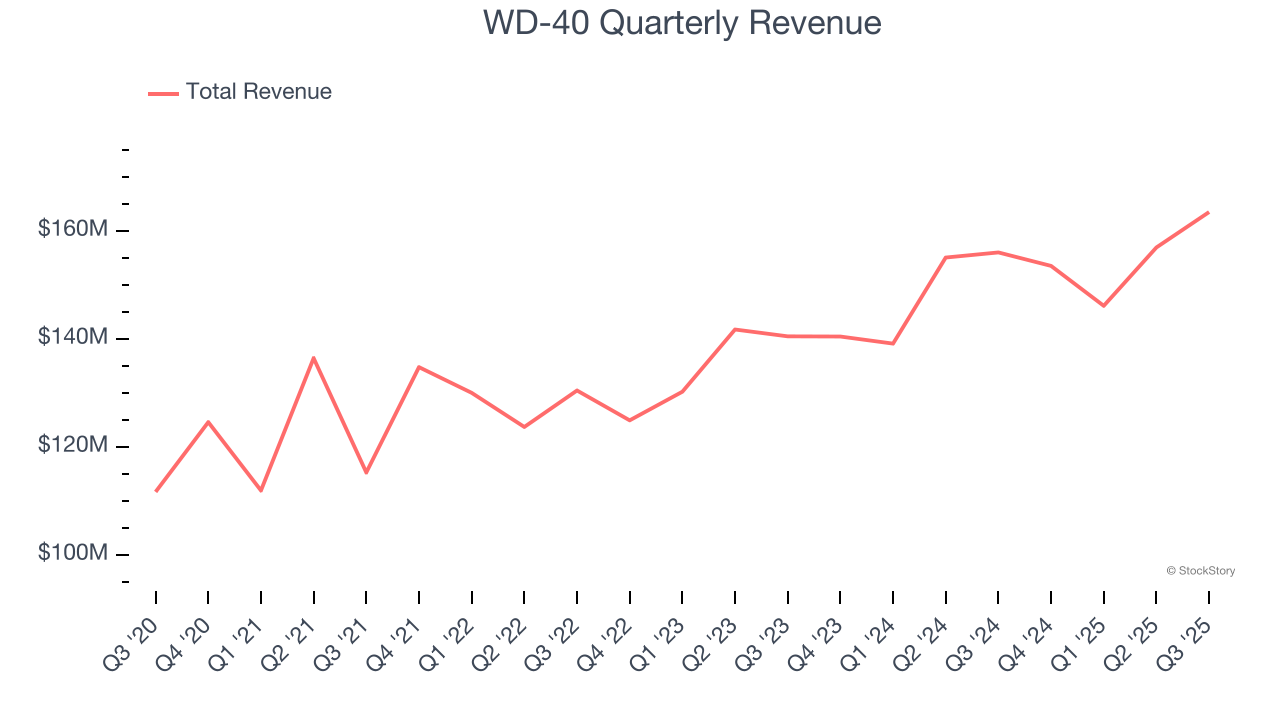

As you can see below, WD-40’s 6.1% annualized revenue growth over the last three years was mediocre. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

This quarter, WD-40 reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 6.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

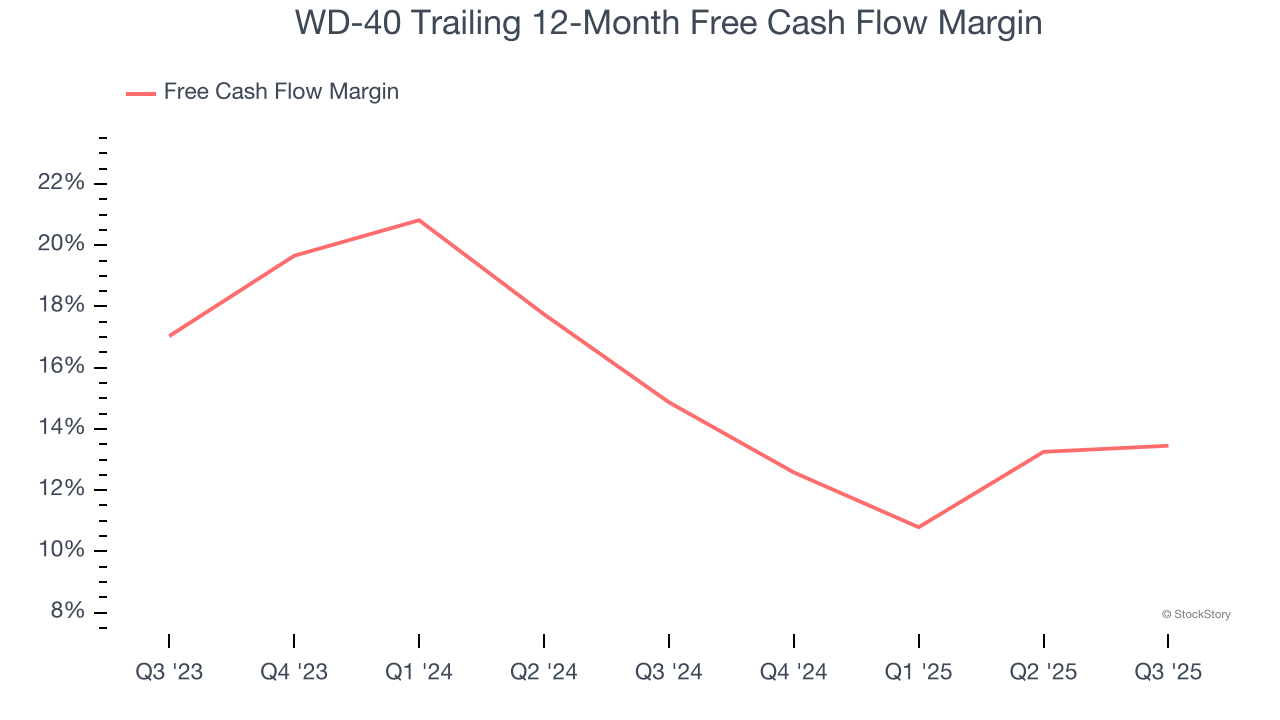

WD-40 has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 14.1% over the last two years.

Taking a step back, we can see that WD-40’s margin dropped by 1.4 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

WD-40’s free cash flow clocked in at $28.59 million in Q3, equivalent to a 17.5% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Key Takeaways from WD-40’s Q3 Results

We were impressed by how significantly WD-40 blew past analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its gross margin missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.3% to $210.01 immediately after reporting.

WD-40 put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.