Not every stock needs a flashy growth story to outperform. Sometimes, the biggest winners are the companies that simply keep executing, quarter after quarter, year after year- it’s all about consistency.

In 2025, a handful of quiet standouts are doing precisely that, delivering substantial year-to-date gains while continuing to reward investors with reliable income. These are businesses with deep moats, disciplined management teams, and a proven ability to thrive across market cycles.

When I look for companies that consistently fit this profile, I like to start with the Dividend Kings list, companies that have raised their dividends for over 50 consecutive years.

With that in mind, I'm focusing on identifying Dividend Kings with long-term value and near-term momentum, based on their year-to-date performance in 2025.

How I came up with the following stocks

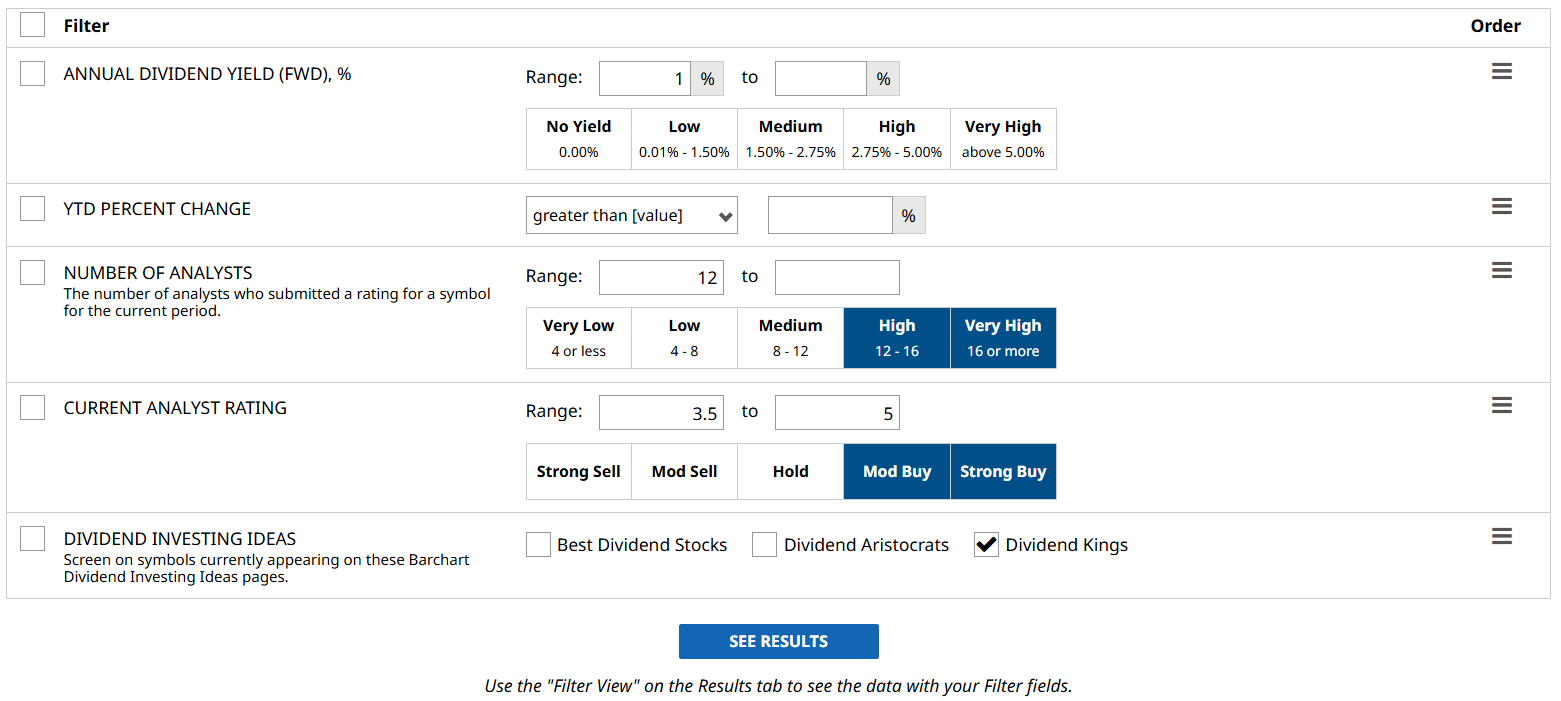

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield (FWD), %: To find companies with at least a 1% yield.

- YTD Percent Change: Left blank to sort the results from the highest to lowest YTD percent change.

- Number of Analysts: 12 or more. The more the analysts, the stronger the conviction.

- Current Analyst Rating: 3.5–5. Stocks that are rated “Moderate” to “Strong Buy”.

- Dividend Investing Ideas: Dividend Kings.

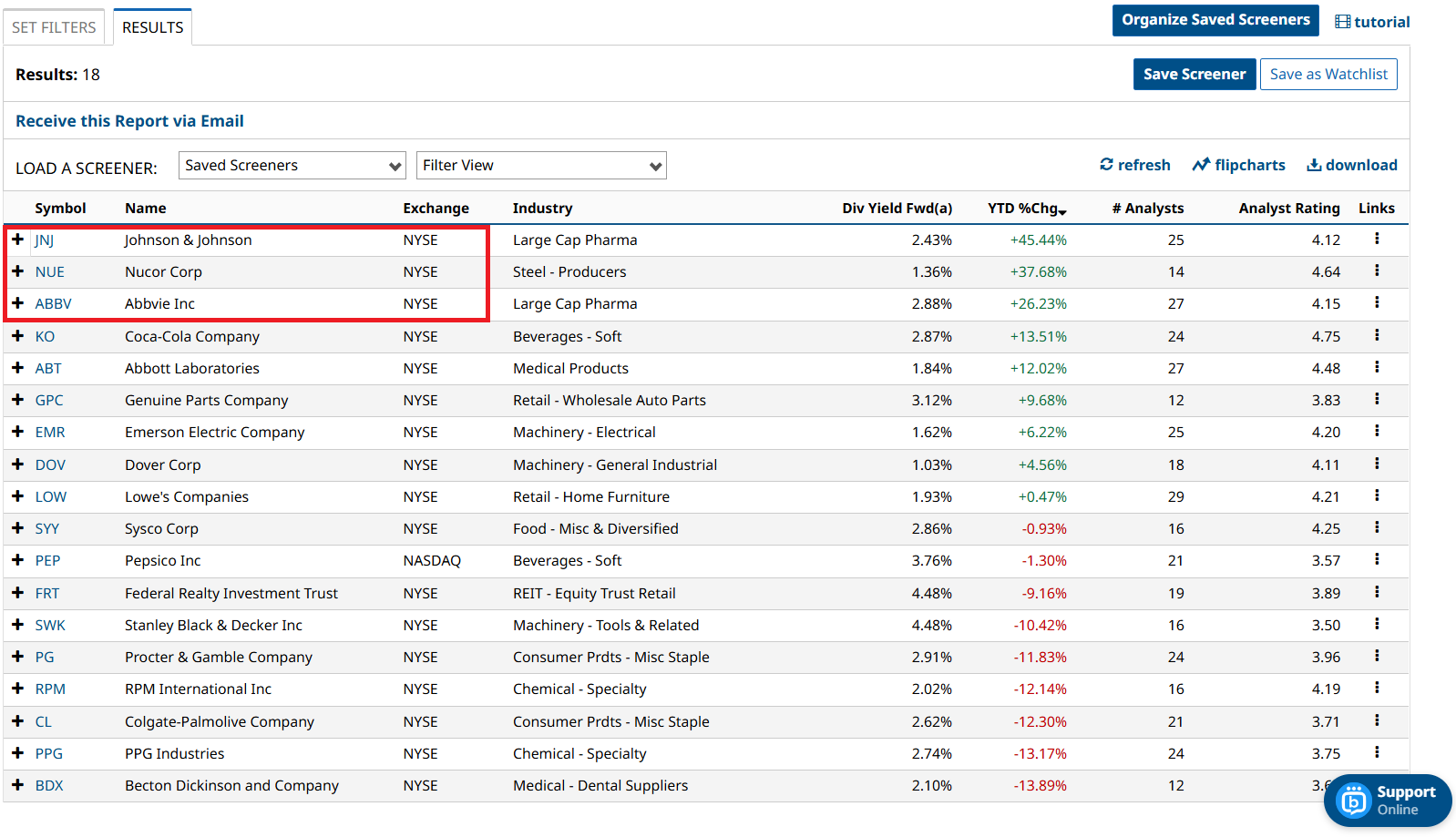

I ran the screen and got 18 results; I’ll cover the top three based on YTD percent change, from highest to lowest.

Let’s start with the first Dividend King:

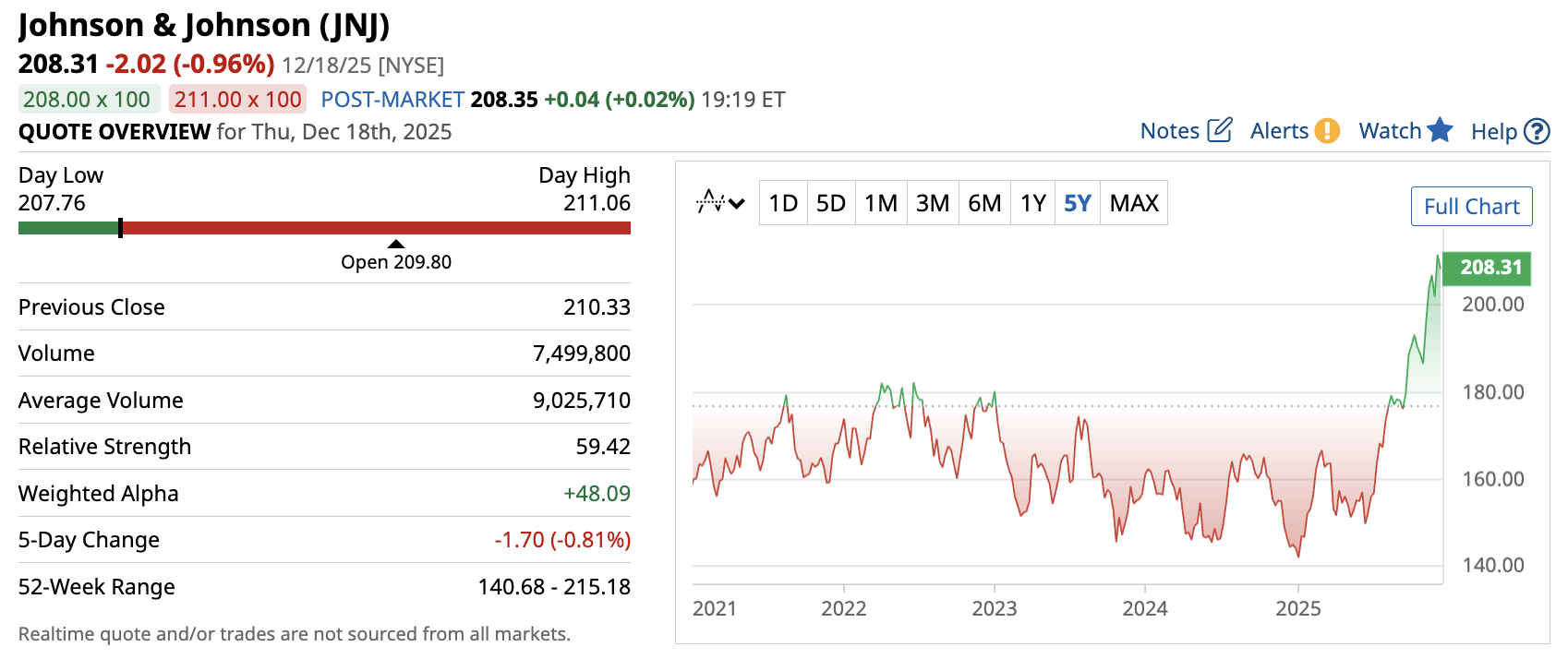

Johnson & Johnson (JNJ)

Johnson & Johnson is one of the biggest companies in the healthcare industry. It manufactures a diverse range of pharmaceutical products and popular brands such as Band-Aid, Tylenol, and Aveeno. However, J&J also makes pharmaceuticals for serious diseases, such as one of its recent innovations, the FDA-approved RYBREVANT FASPRO. This is a five-minute subcutaneous lung cancer treatment that improves survival and reduces treatment burden.

The company’s recent financials reported sales rose as much as 7% YOY to $24 billion, while its net income grew over 90% to $5.2 billion. With a strong performance, I'm not surprised that JNJ stock is up over 45% year-to-date, making it the best Dividend King of 2025 on my list.

In terms of payouts, Johnson & Johnson pays a forward annual dividend of $5.20, yielding approximately 2.5%. With that, a consensus among 25 analysts rates the stock a “Moderate Buy”. The stock has a high target of $240, suggesting as much as 15% upside over the next year.

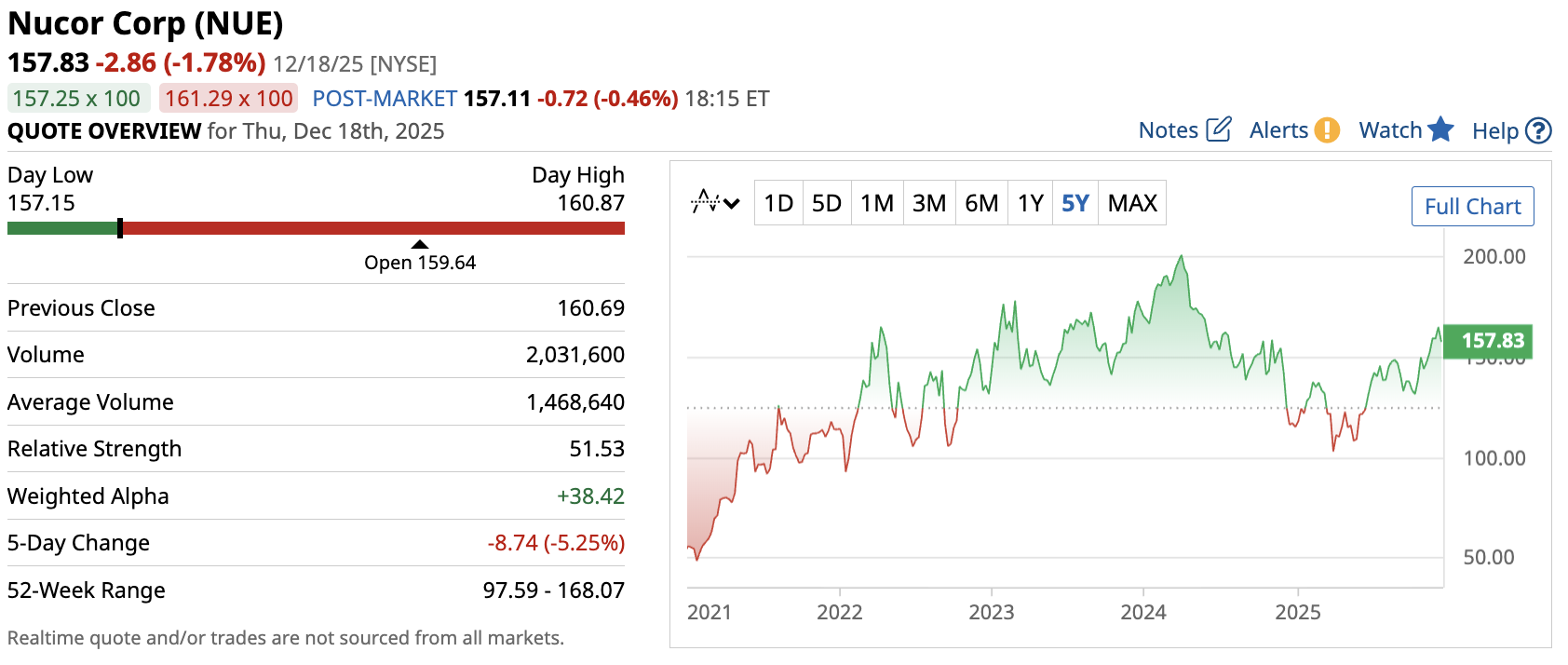

Nucor Corp (NUE)

The second Dividend King on my list is Nucor Corp, North America’s biggest steel manufacturer and recycler. Its product portfolio covers construction, infrastructure, and the automotive industry. Nucor is also regarded as the most profitable steel company. With that, Nucor’s recent quarterly financials reported sales rising around 15% YOY to $8.5 billion. Its net income increased by over 140% to $607 million, and it is up almost 38% year to date.

Nucor pays a forward annual dividend of $2.24, translating to a yield of around 1.36%. At the same time, a consensus among 14 analysts rate the stock a “Strong Buy”, a rating that has been consistent over the past three months. Aside from that, stockholders could be in for as much as 27% upside over the next 12 months if it hits its $200 target.

Abbvie Inc (ABBV)

The last Dividend King on my list is AbbVie Inc., another pharmaceutical manufacturer, just like Johnson & Johnson. AbbVie spun off from Abbott Laboratories and today specializes in drugs that address a wide range of diseases.

The company’s recent financials reported that sales grew 9% YOY to $15.8 billion. In comparison, its net income dropped 88% to $186 million, primarily due to higher operating expenses, acquisition-related charges, and competitive pressure for Humira, AbbVie's flagship product. Still, ABBV stock is up over 26% year-to-date, highlighting a solid performance for 2025.

AbbVie pays a forward annual dividend of $6.92, translating to a yield of around 3%, the highest on this list. Further, a consensus among 27 analysts rate the stock a “Moderate Buy”. There’s also as much as 30% upside in ABBV stock if it hits its high of $289.

Final thoughts

So, there you have it, the three top performing Dividend Kings of 2025 based on their year-to-date change. These companies may not offer the highest yields, but they offer resilience and dependable payouts that are likely to withstand even the worst market conditions. For investors looking for stability, consistent earnings, and a payout, these stocks could be a great addition to your portfolio.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Dividend Kings Delivering Generational Income & Market-Beating Returns

- Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026

- Broadcom Stock Just Raised Its Dividend by 10%. Should You Buy AVGO Stock Now?

- Weight Watchers Is Going All In on GLP-1 Drugs. Should You Buy WW Stock Here?